Finance books to read in your 20s – “Financial experts have noted that “not saving” for retirement is No. 1 on the list of REGRETS for about 60% of adults.” According to a recent study.*¹

When we were young, we looked up to most of the adults in our lives and considered them as role models. We believed they had their lives figured out and that they were in control.

Once we became adults, we were shocked to find out that life wasn’t rainbows and fairy tales, we found out that life was hard.

Once we reach our 20’s we take on more responsibilities in life and we look for ways to be more independent. To do that, we need to be financially stable and that can be hard to do.

With proper help from those who went down the same road, we get to learn how to build a strong financial system and eventually improve our lives.

This is where finance self-help books come in, they are written with the purpose of making the reader’s life better. They feature great pieces of advice that would never grow old.

Everyone in their 20s must read these 5 finance books as they will guarantee us a better financial life:

Rich Dad Poor Dad by Robert Kiyosaki and Sharon Lechter

In 1997, Kiyosaki and Lechter published Rich Dad Poor Dad and it became a must-read. 24 years later and it’s still one of the bestsellers when it comes to finance books.

It features two dads who had different ideas on making and investing money. In general, it talks about how we can be rich without earning a high income.

Favorite quote: “There is a difference between being poor and being broke. Broke is temporary. Poor is eternal.”

Think and Grow Rich By Napoleon Hill

Almost a century old, this book was published in 1937 and it remained Hill’s bestseller since then.

To write this book, Hill researched over 40 millionaires to find out what led them to become millionaires.

His main idea was that whatever our mind can believe, it can achieve. In other words, we can do whatever we set our mind to.

Favorite quote: “One of the most common causes of failure is the habit of quitting when one is overtaken by temporary defeat.”

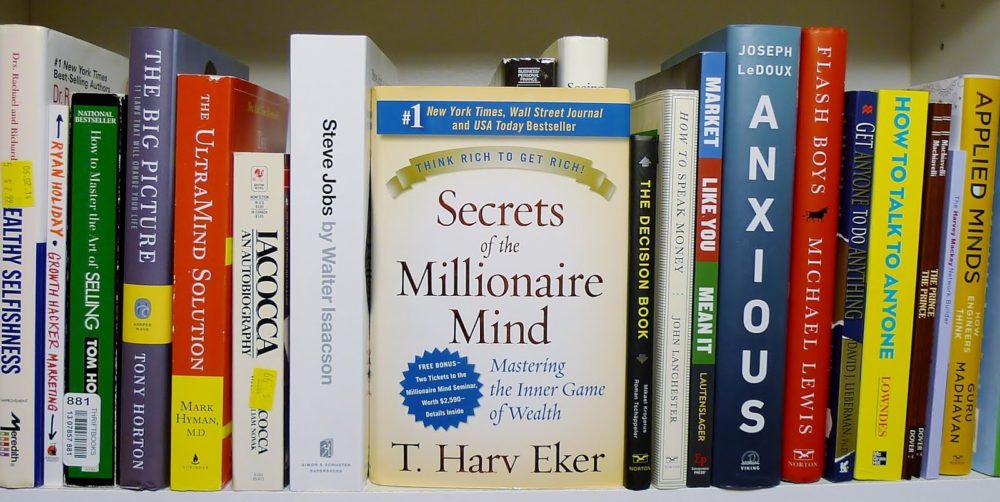

Secrets of The Millionaire Mind by T. Harv Eker

In 2005, businessman and motivational speaker Eker published this book on how we inherit behavioural patterns from our parents and how it affects our wealth-earning habits.

It also talks about how we need to be 100% committed to creating wealth to get it.

Favorite quote: “If you are saving your money for a rainy day, what are you going to get? Rainy days! Stop doing that. Instead of saving for a rainy day, focus on saving for a joyous day or for the day you win your financial freedom.”

The Richest Man in Babylon by George Samuel Clason

Published in 1926, this book offers advice in the form of parables set 4000 years ago in Babylon. A century later and it’s still considered a classic self-help book.

It offers lessons to increase your wealth to live a richer and better life. It also helps us know the difference between making money and being rich.

Favorite quote: “Where the determination is, the way can be found.”

Last in this Finance Books to Read in Your 20s List

Broke Millennial: Stop Scraping by and Get Your Financial Life Together by Erin Lowry

Lowry published this book in 2017. It’s written for adults in their 20’s who unintentionally make bad decisions when it comes to money.

She gives different lessons on how to manage our finances to live a free and confident financial life.

Favorite quote: “Trying to change how you spend or save money without understanding why it’s difficult in the first place probably means you’ll slip up.”

Final thought

Please remember that there is a difference between reading a book and learning something from it. Self-help books require your full attention in order to help you. Good luck!

*Sources: 1